Summer Student Hiring

Myers LLP is pleased to announce it will be hiring a summer student for the 2024 Summer term (May – August). Students who are currently completing their first year of law school are encouraged to apply.

Visit our Careers Page for more information.

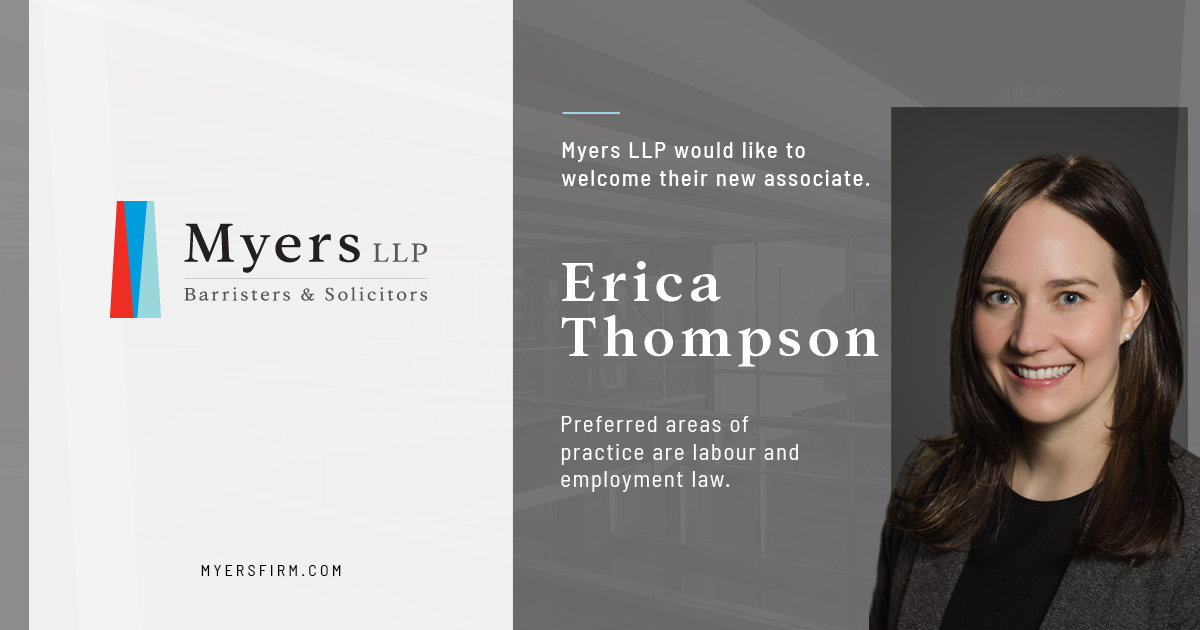

Myers LLP expands our team with addition of Erica Thompson

Myers LLP is happy to announce the arrival of Erica Thompson, our newest associate bringing expertise in labour and employment law. Join us in extending a warm welcome to Erica as she becomes an integral part of our legal team.

Garth Smorang, K.C. is the 2023 Richard J. Scott Award Recipient

Myers LLP would like to congratulate our very own Garth Smorang, K.C., on receiving the 2023 Richard J. Scott Award. This prestigious accolade, conferred by The Law Society of Manitoba, was established in 2013 in tribute to the legacy of Richard J. Scott, former Chief Justice of Manitoba. Annually granted, the award recognizes individuals who significantly contribute to the advancement of the rule of law and the fostering of a robust, independent legal profession through various avenues, such as advocacy, litigation, teaching, research, writing, and mentoring.

Throughout his distinguished career, Garth has demonstrated his commitment to advocating for workers across diverse contexts, playing a pivotal role in groundbreaking unfair labour practice decisions. His substantial pro bono contributions extend beyond legal realms, encompassing governance within the profession, education in labour law, mentorship of emerging legal professionals, and broader community engagement. This award is a testament to Garth’s exceptional dedication and significant impact in advancing legal principles and professional standards in Manitoba.

Myers LLP Welcomes Karen and Sharna to the team

Myers LLP is pleased to announce the addition of Karen Wittman as a new partner and Sharna Nelko as a new associate to our team. Both Karen and Sharna specialize in civil litigation and employment law, embodying a wealth of expertise in these practice areas. We extend a warm welcome to Karen and Sharna, anticipating their meaningful contributions to the firm’s continued success.

Myers LLP Secures $19.4-Million Appeal Victory for University of Manitoba Professors in Charter Challenge

The Manitoba Court of Appeal upheld a $19.4-million Charter damages award compensating University of Manitoba professors, following the government’s unsuccessful appeal. The compensation addresses lost earnings, interest, and strike costs due to the province’s secret intervention in contract negotiations that led to a 2016 campus strike. Myers LLP successfully argued that the University of Manitoba Faculty Association’s right to association under the Charter had been breached. This precedent-setting case opens the door to further Charter damages remedies and may have implications beyond labor and employment issues. The government has until the end of September to request a follow-up appeal to the Supreme Court of Canada.

Congratulations to Andrew E. Fenwick and Nikolai Bola

Congratulations to Andrew E. Fenwick and Nikolai Bola for receiving their Call to the Bar in Manitoba on June 15. Further congratulations to Nikolai for being awarded the A. Montague Israel’s QC Prize, awarded to a student who has demonstrated all-around excellence and who is seen to possess the scholarship, character, skill and breadth of interest that Mr. Israels valued and exemplified in his life! We are thrilled to have both of you continue to work with us as associates.

Josh Weinstein has become a Fellow of the American College of Trial Lawyers

Winnipeg, Manitoba, March 11, 2022 – JOSH WEINSTEIN has become a Fellow of the American College of Trial Lawyers, one of the premier legal associations in North America.

The induction ceremony at which Josh Weinstein became a Fellow took place recently before an audience of over 600 people during the recent Spring Meeting of the College in Coronado, California.

Founded in 1950, the College is composed of the best of the trial bar from the United States, Canada, and Puerto Rico. Fellowship in the College is extended by invitation only and only after careful investigation, to those experienced trial lawyers of diverse backgrounds, who have mastered the art of advocacy and whose professional careers have been marked by the highest standards of ethical conduct, professionalism, civility, and collegiality. Lawyers must have a minimum of fifteen years of trial experience before being considered for Fellowship.

Founded in 1950, the College is composed of the best of the trial bar from the United States, Canada, and Puerto Rico. Fellowship in the College is extended by invitation only and only after careful investigation, to those experienced trial lawyers of diverse backgrounds, who have mastered the art of advocacy and whose professional careers have been marked by the highest standards of ethical conduct, professionalism, civility, and collegiality. Lawyers must have a minimum of fifteen years of trial experience before being considered for Fellowship.

Membership in the College cannot exceed one percent of the total lawyer population of any state or province. There are currently approximately 5,800 members in the United States, Canada, and Puerto Rico, including active Fellows, Emeritus Fellows, Judicial Fellows (those who ascended to the bench after their induction) and Honorary Fellows. The College maintains and seeks to improve the standards of trial practice, professionalism, ethics, and the administration of justice through education and public statements on the independence of the judiciary, trial by jury, respect for the rule of law, access to justice, and fair and just representation of all parties to legal proceedings. The College is thus able to speak with a balanced voice on important issues affecting the legal profession and the administration of justice.

Josh is a partner at Myers LLP and has been practicing at the firm for 25 years in the areas of Criminal Defence, Administrative Law, and Professional Discipline. Josh is an alumnus of The Robson Hall School of Law at the University of Manitoba, a Past President of the Manitoba Bar Association, Past Chair of the Canadian Bar Association’s Criminal Justice Section, and a previous recipient of the CBA’s Douglas Miller Award.

Michael Clark has been appointed a Judge of The Provincial Court of Manitoba

Myers LLP is pleased to announce that Michael Clark has been appointed a Judge of The Provincial Court of Manitoba. Michael has been a partner since 2015 and has practiced in the areas of Child Protection and Civil Litigation.

Myers LLP named one of Canada's Best Law firms

Myers LLP is honoured to have been named one of Canada’s Best Law Firms for 2022 by the Globe & Mail’s Report on Business in the field of Labour and Employment Law.

Labour arbitrators have exclusive jurisdiction to hear human rights complaints from unionized workplaces

By Cleyton Rückl

The Supreme Court of Canada recently issued its decision in Northern Regional Health Authority v. Horrocks, 2021 SCC 42, ruling that disputes involving human rights complaints from unionized workers fall within the exclusive jurisdiction of labour arbitrators.

This dispute concerns the employer’s response to Ms. Horrocks’ attendance at work under the influence of alcohol – requiring that she sign an abstinence agreement, and terminating her employment for breaching the agreement. Ms. Horrocks filed a complaint with the Manitoba Human Rights Commission, and the issue was whether an adjudicator has jurisdiction to hear complaints from unionized workplaces.

Writing for the majority, Justice Brown explained that where the legislation includes a mandatory dispute resolution clause, an arbitrator empowered under that clause has jurisdiction to decide all disputes arising from the collective agreement, subject to clearly expressed legislative intent to the contrary.

The Labour Relations Act requires every collective agreement to include a provision for final settlement of all disputes about the meaning, application, or violation of the agreement – the mandatory arbitration clause. And while The Human Rights Code gives broad jurisdiction to the Commission to receive, investigate and refer complaints to adjudication, there are no provisions that expressly displace the exclusive jurisdiction of a labour arbitrator established by the mandatory arbitration clause. As a result, only labour arbitrators have jurisdiction to hear human rights complaints from unionized workplaces.